Authored by Mike Shedlock via MishTalk.com,

Germany has two major problems, an aging workforce and deindustrialization. Both will impact the EU for a long time…

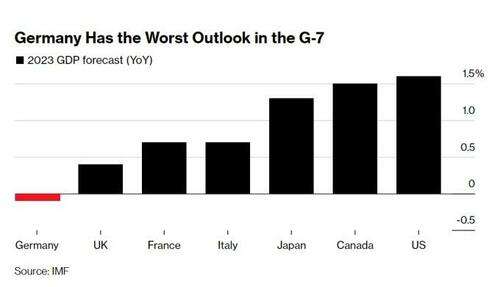

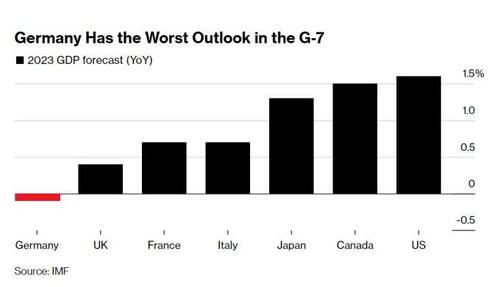

Germany outlook from IMF via Bloomberg discussion below.

Adam Taggart, Founder & CEO, Wealthion, interviewed me on a wide variety of topics. I will post the interview as soon as it’s available.

One of Adam’s final questions was “What is the bull case for the Us stock market?”

My answer was along the lines of “The US isn’t Germany.”

The US Isn’t Germany

The EU lags the US in AI, and in technology in general. The EU is fearful of AI and wants to rein it in.

What does Germany have other than aging infrastructure, SAP software, and diesel technology it is desperate to protect.

I’ve talked this before, but Microsoft, Google, Amazon. and Facebook could not exist in the EU because the EU would bust the corporations up in the name of increasing competition before the companies ever got big in the first place.

Europe’s Economic Engine Is Breaking Down

Bloomberg reports Europe’s Economic Engine Is Breaking Down

That is a gift article but it’s only valid for a week. Here are some key excerpts, subtitles in bold are mine.

Energy

Decades of flawed energy policy, the demise of combustion-engine cars and a sluggish transition to new technologies are converging to pose the most fundamental threat to the nation’s prosperity since reunification. But unlike in 1990, the political class lacks the leadership to tackle structural issues gnawing at the heart of the country’s competitiveness.

The most pressing issue for Germany is getting its energy transition on track. Affordable power is a key precondition for industrial competitiveness, and even before the end of Russian gas supplies, Germany had some of the highest electricity costs in Europe. Failure to stabilize the situation could transform a trickle of manufacturers heading elsewhere into a stampede.

The bitter reality is that resources for generating that much clean power are limited in Germany by its relatively small coastline and lack of sun. In response, the country is looking to build a vast infrastructure to import hydrogen from the likes of Australia, Canada and Saudi Arabia — banking on technology that hasn’t been tested at this scale.

Autos

Nowhere is Germany’s disappearing technological edge more obvious than in the auto sector. While brands like Porsche and BMW defined the combustion-engine era, Germany’s electric cars have struggled. BYD Co. overtook VW to become the best-selling car brand in China last quarter. Key to its push was an electric model that costs around a third of VW’s ID3, but offers greater range and connectivity with third-party applications.

Banking

Germany’s two biggest listed banks — Deutsche Bank AG and Commerzbank AG — have been mired in controversy for years, and while they’re on the mend, they’re still undersized compared to Wall Street peers. Their combined market capitalization is less than a tenth of JPMorgan Chase & Co.’s.

Digital Technology

In technology, Germany’s biggest player is SAP SE, which dates from the 1970s and makes complex software that helps companies manage their operations. Germany’s lack of investment is particularly acute in digital technology. Despite infrastructure that had it ranked 51st in the world for fixed-line Internet speeds, it had the fourth-lowest spending among OECD countries relative to the economy’s size.

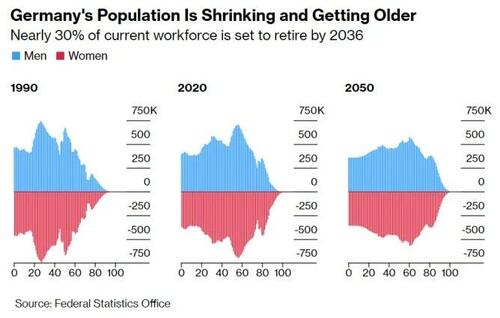

Aging Population

Fragmentation risks intensifying as the population ages, pitting comfortable pensioners against young people worried about their futures. The tensions have sparked disruptive protests, and authorities In june searched 15 properties across Germany in connection with an investigation against a group of climate activists.

Germany’s industrial base is already feeling the pinch of its demographic shift. Recent surveys have found 50% of firms cut output due to staffing problems, costing the economy as much as $85 billion per year.

In a recent report, the OECD put the scale of the challenges in stark terms: “No major industrialized economy has ever had the very basis of its competitiveness and resilience so systematically challenged by changing social, environmental and regulatory pressures.”

Germany’s Population

There’s much more in the Bloomberg report. Inquiring minds will want to give that free link a closer look.

Of note, Germany is dependent on China for German car exports. That pressure is about to reverse although Germany has a huge trade deficit with China already.

Not Pretty Anywhere

It’s not pretty anywhere, as I mentioned to Adam.

Compared to Germany, the US has far more bright spots. From a stock market perspective, however, those assets are hugely overpriced.

Importantly, the US will not decouple from the global economy in 2023 anymore than China did in 2008 or 2020.

Inflation pressures from Biden’s energy policies, deglobalization, and decarbonization will prevent the Fed from stepping on the gas when the next US recession starts.

Recession When?

The EU defines recession differently than the EU. The EU goes by the adage of two consecutive quarters of declining GDP.

By that measure, the EU is in recession now. The Guardian reports Eurozone sinks into recession as cost of living crisis takes toll

The eurozone slipped into recession in the first three months of the year, after official figures were revised to show the bloc’s economy shrank as the rising cost of living weighed on consumer spending.

Figures from Eurostat, the EU’s statistical agency, showed gross domestic product (GDP) fell by 0.1% in the first quarter of 2023 and the final three months of 2022 after revisions to earlier estimates. A technical recession is generally defined as two consecutive quarters of negative growth.

I don’t think much of that recession definition, and it misses the 2020 Covid recession that was only 2 months long.

Gross Domestic Income GDI Suggests the US Is in Recession Right Now

There are conflicting signals in the US. GDP and GDI are supposed to measure the same thing but in two different ways.

They don’t. But after enough revisions they will.

For discussion, please see Gross Domestic Income GDI Suggests the US Is in Recession Right Now