In a note to clients, the team at Deutsche Bank led by veteran strategist Jim Reid paints an ominous outlook for the US economy. The trillion-dollar question likely swirling around Reid’s head revolves around the potential consequences of the most aggressive hiking cycle in history, specifically whether it could trigger a hard economic landing. In his report titled “A Time Capsule For The Future,” he uses an array of macro data over decades, pointing out what contributed to past downturns and asking whether today is similar and if history repeats.

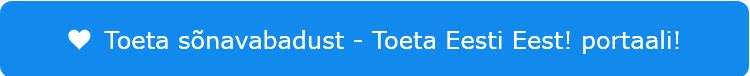

Reid provides nearly two centuries of US money supply (year-on-year % change) data that shows the fastest collapse since the 1930s. This is a major red flag for the economy and capital markets, and past collapses have led to panics, recessions, and depressions.

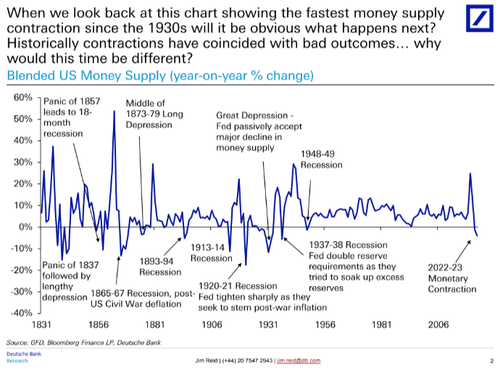

With the money supply shrinking year-on-year since December, another alarming development has occurred: the collapse of Silicon Valley Bank, Signature Bank, and First Republic Bank. Even though JPMorgan CEO Jamie Dimon recently said, “This part of the crisis is over,” Reid warned the regional banking fiasco “risks credit contraction going forward.”

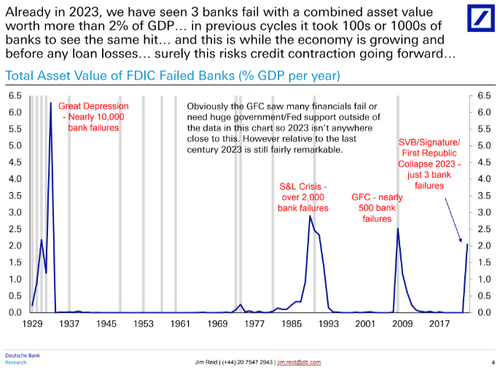

Moving onto real estate, Reid asks: “Will we look back on this chart and conclude it was obvious that big falls were still ahead of us in terms of house prices?”

And readers remember we’ve pointed out (read: here) how the regional bank turmoil has spread to the commercial real estate sector. Reid tends to agree with our view of the CRE downturn here as lending standards tighten.

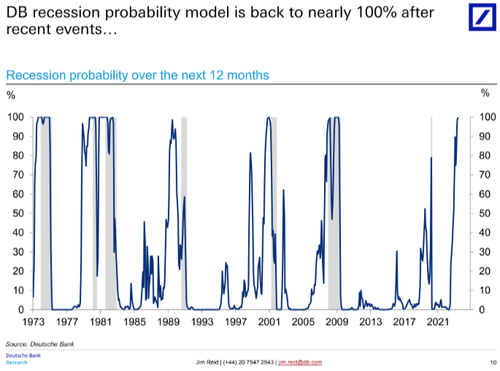

Considering the contraction in money supply, turmoil in the banking sector, and looming problems in the residential and commercial real estate markets, Reid shows DB’s recession model predicts a 100% chance of a recession within the next 12 months.

He draws a horizontal line across a chart showing that the Fed’s number of hikes over the last 12 months has only occurred twice during the previous seven decades, one in the mid-1970s and the other in the early 1980s, leading to recession.

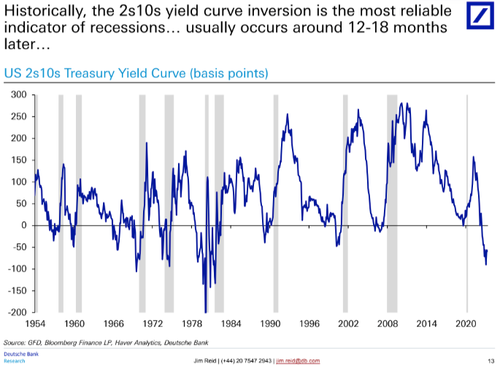

Then there is the yield curve: the 2s10s has inverted before all of the last 10 US recessions, and it takes 12-18 months for the lag on average, but some cycles take longer….

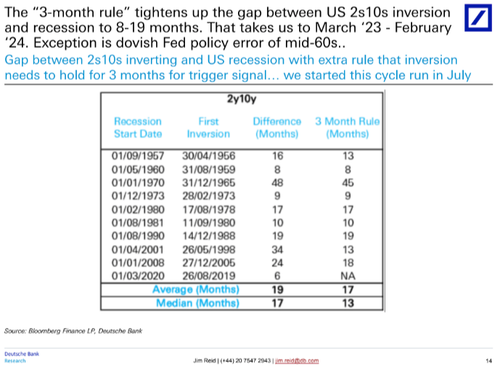

To simplify, Reid notes the “3-month rule” tightens up the gap between US 2s10s inversion and recession to 8-19 months. That takes us to March ’23 – February ’24. The one exception is the Fed policy error of the mid-1960s.

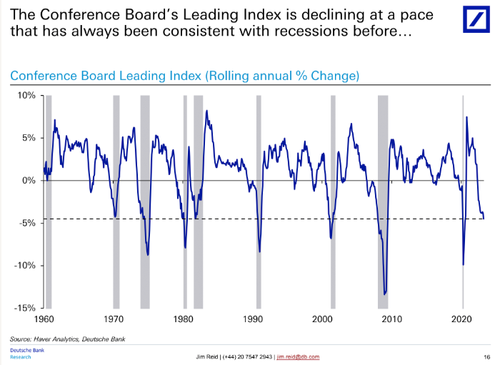

Meanwhile, the Conference Board’s Leading Index continues to slide, one of the longest streaks of decline since ‘Lehman.’

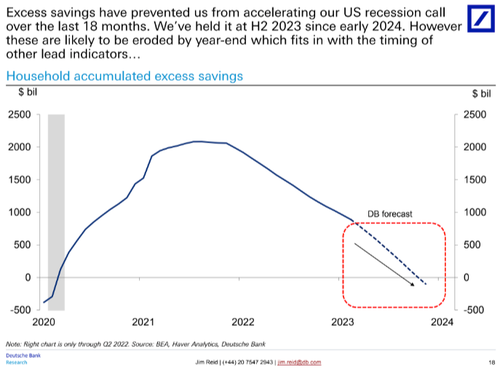

As the economic storm gathers, he shows excessive household savings continue to be depleted. There goes the biggest driver of the US economy in the coming quarters (unless consumers continue to leverage up with credit card debt).

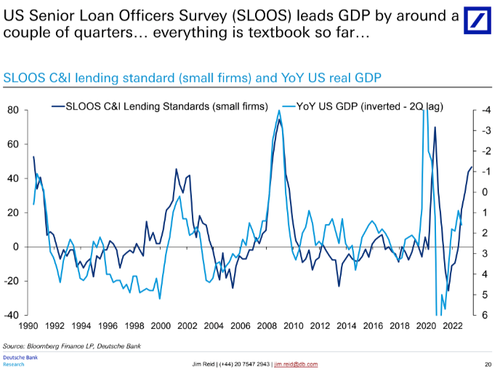

So with that in mind, let’s take a look at some of the key “lag” indicators, starting with the US Senior Loan Officers Survey (SLOOS), which, as we noted recently, has painted a “dire picture” for the economy as “Loan Standards Are Approaching Record Tightness As Loan Demand Plummets,” and which leads GDP by two quarters…

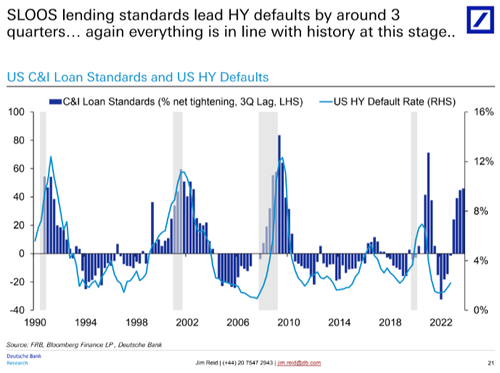

… and leads to a surge in high yield defaults by around three quarters…

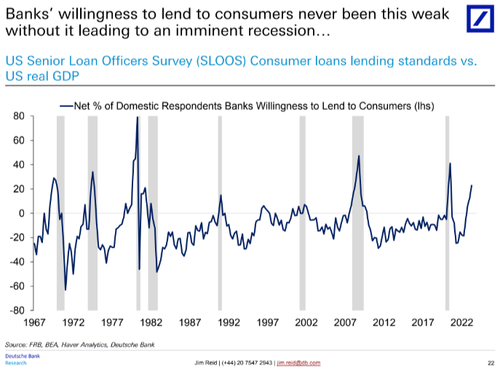

“Banks’ willingness to lend to consumers never been this weak without it leading to an imminent recession…,” Reid noted.

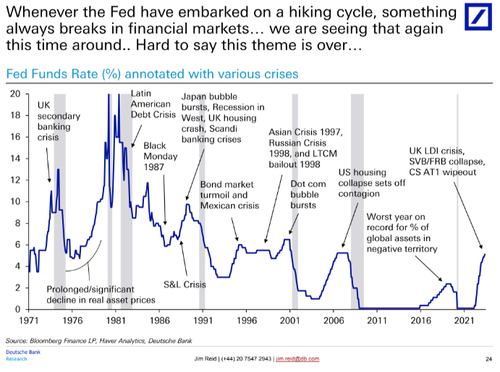

History has shown us that interest rate hiking cycles end with a bang.

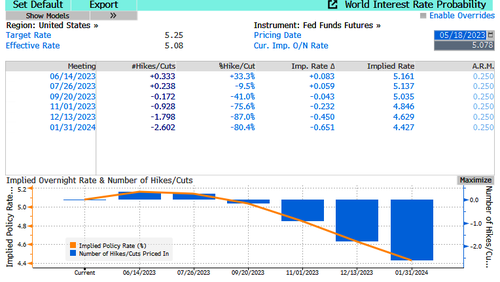

Separately, interest rate swaps are pricing a terminal rate of around 500bps with 2.5 cuts through January 2024.

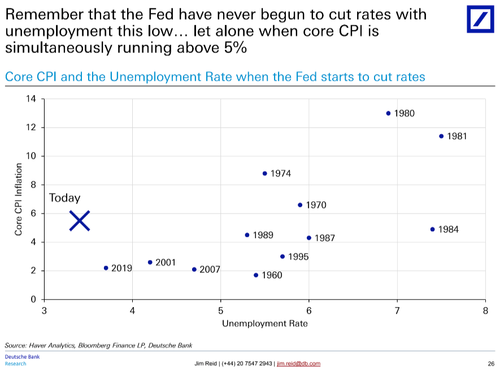

“Remember that the Fed have never begun to cut rates with unemployment this low… let alone when core CPI is simultaneously running above 5%,” Reid pointed out.

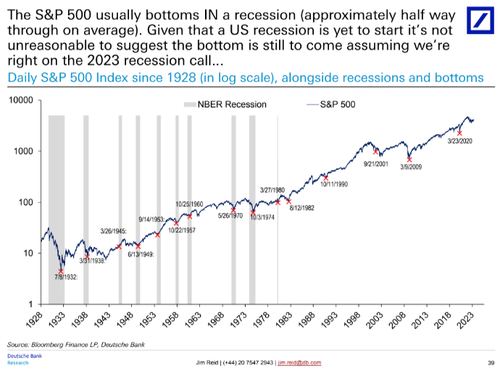

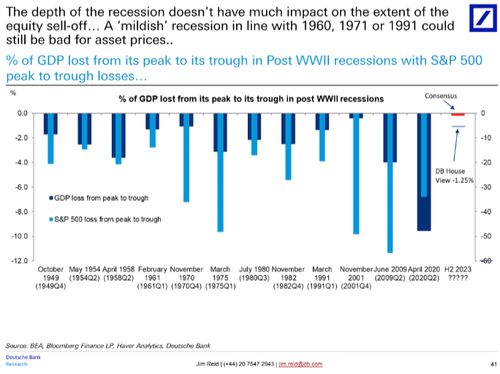

Returning to capital markets, he said, “Given that a US recession is yet to start it’s not unreasonable to suggest the bottom is still to come assuming we’re right on the 2023 recession call..”

Adding a mild recession in line with the 1960s and 70s could still be bad for asset prices.

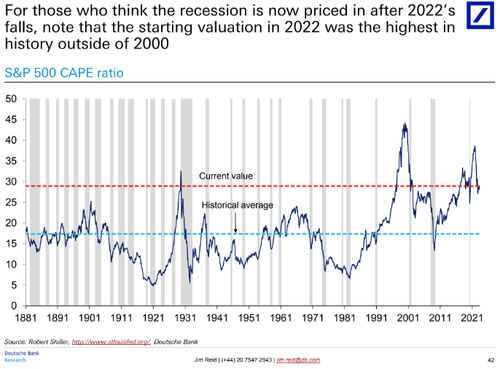

Valuations are still at lofty levels.

Given all of this, the biggest question is whether anyone in the Biden admin realizes that economic storm clouds are gathering ahead of the 2024 election year.