It’s not that Gold has diverged from dxy/real/nominal yields in the US. It’s just that it is tracing the real/nominal yields of its marginal buyer…China

Unlocked: They Want the (Gold) Correlations

Authored by GoldFix ZH Edit

Intro:

Bank analysts and financial media have been wondering aloud why Gold has not been following its “traditional” US financial correlations. Some are warning (again) there will be hell to pay when these correlations return. That may be true in the short term. But consider this: Economic power is moving east. Along with that eastern migration comes pricing power over commodities. As we show below, Traditional correlations (a proxy for economic drivers) are fine if you use the right country1.

Contents:

- Gold and Dollar Correlations

- Dollar Correlations Are Not Broken

- China Correlations Matter

- Correlations are Governors

- What Governs How Much They Want The Gold?

- Goldman’s Trading Desk Notices

- Correlations and Unipolarity/Multipolarity

- More Charts

1- Gold and Dollar Correlations Still Work

Gold is priced in dollars globally. But gold is being bought in Yuan which is increasingly *not* economically tied to Dollars. Put another (mercantilist) way; As global trade fragments, so does global price. We show below that gold is increasingly a proxy for China’s economy. We also suspect the banks covering the asset will soon start talking about it this way. The correlations are fine, if you know where to look.

Gold is still correlated to the USD Gold is still priced as an opportunity cost to real US Bond yields. These correlations still exist. They are simple mathematical facts. There is no denying this. Specifically:

Gold is Still Priced in Dollars

Gold is still priced in USD, therefore the higher the buying power of the USD (the less dollars are available) , the lower the price of Gold. That’s just a supply/demand fact.

- Yet gold remains buoyant in the face of a strong USD. Why?

Owning Gold Still Has Opportunity Cost

Similarly, the higher real rates are, the bigger the opportunity cost to own Gold. That is also a fact related to PV and FV of money.

- How much interest are you willing to give up now for the possibility to make money on Gold in the future?

If these correlations still exist, what is going on? US financial correlations are resetting to make room for other forces.

2- Dollar Correlations Are Not Broken

From: Gold, The Everything Hedge Revisited

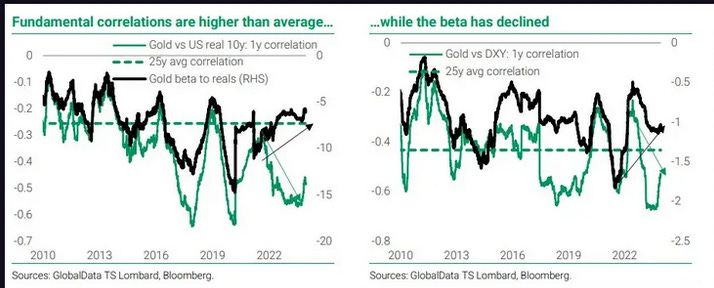

Gold hasn’t decoupled from yields and the dollar, but the beta has decreased. While a gap has opened up, this does not mean the relationship has broken down.

So; why is Gold higher if these relationships are not broken? The simple answer is, China wants the gold. But it’s more than that. They are driving correlations now as well. By now we all know why “they want the gold”. The world needs a trustworthy Store of Value for trade with no counterparty risk to replace US Bonds.

Given the decreased reliability of USD correlations for pricing Gold what correlations are stepping into the breach? The answer is China correlations.

3- China Correlations Matter

China is…

- buying Gold.

- ignoring the USD and real yields.

- spearheading the BRICS multipolarity.

- the second largest economy in the world.2

The Chinese economy is increasingly governing the price of Gold now3. Therefore, the price of Gold *must* be correlating with some Chinese data as well. That data will give a clue as to what is macro-economically (we know the secular reasons) driving both the PBOC and their public to buy Gold. So what is governing the buying?

4- Correlations Govern China’s Buying

Correlations in reality are manifestations of economic limitations on supply/demand behavior. If your bank account is low on money, you spend less. That is a correlation governing your behavior. That is all correlations truly are. They are manifestations of economic governors/limiters on behavior4.

So assuming the buyers of gold are not stupid, what is limiting their behavior? What is Gold correlated to now?

We need a new correlation at the table. What limits the buying? Something has to!

5- What Governs How Much They Want The Gold?

Put another way. If gold is not governed by the USD lately, and Gold is ignoring the rate of interest money can earn in US Bonds… what does it care about? What is Gold correlated to if not the US dollar or US Rates now? The answer is, China’s bonds and China’s currency. For this note, let’s ignore the Yuan currency, which is restricted by government. That leaves their domestic bond market. Let’s take a quick look at their recent policies.

China’s real bond yields are dropping precipitously now. China is using targeted QE to boost its economy. China has thus reduced the opportunity cost for its citizens to own Gold (and stocks) by completely burying its bond yields.

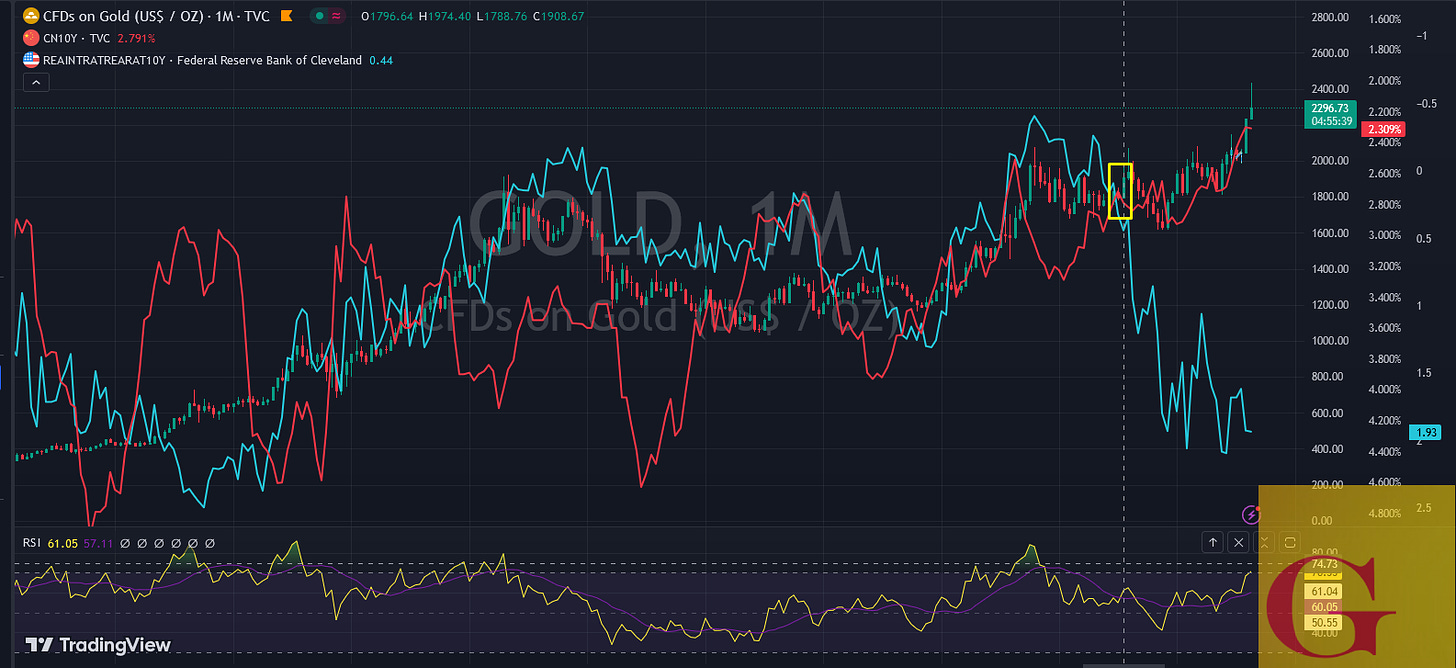

Gold versus CGB yields (inverted)….

Gold versus US Real Rates (inverted)…

Gold is tied to China’s economy right now. From a macro point of view, China is in a deflationary problem. From a secular point of view, this is part of their retooling their finances for a BRICS launch. Thus, when they successfully weaken the Yuan, it should drive Gold’s price down somewhat as their buying power will diminish.

The western world thinks that by directing their citizens to buy Gold they are adding to deflationary trouble. China feels (we think) that they must buy more gold as an SOV in order to finally internationalize the Yuan for BRICs trade. China is doing a bit of a balancing act right now it seems. Here is a Goldman institutional trader’s recent comment on the concept:

6- Goldman Takes Note

China 10yr yields have been a one directional trade (lower). Despite growth in the west the China economy has struggled to adapt to a slumping property market and a thematic of onshoring/re-shoring.

Last couple days some hopefulness on stimulus ahead of politburo meeting, some optimism on property side and additional auto stimulus. Given the amount of gold buying out of China perhaps this is much more impactful than we appreciate. It’s not that Gold has diverged from dxy/real/nominal yields in the US it’s just that it is tracing the real/nominal yields of its marginal buyer…China

China is increasingly driving the world economy right now. The key phrase stated by the bank is:

It’s not that Gold has diverged from dxy/real/nominal yields in the US it’s just that it is tracing the real/nominal yields of its marginal buyer…China

Gold, along with every other measure of the global economy is increasingly correlated to China’s economy and therefore its data.Ultimately, If Gold is correlated to the USD, Real Yields which in turn correlate to US economic power; What does Gold’s price ignoring those correlations say about US economic power? What then, does the title “Global Reserve Currency” mean in an economically decentralized multipolar world? That’s the correlation story.

Correlations aren’t breaking. Dominance is.

7- Correlations and Unipolarity/Multipolarity:

What is breaking is the Unipolarity of the US economy dominating all global asset prices. In the currency world this is described as rising Multi-polarity as a reflection of other currencies growing in influence challenging the need and status for the USD as a Global Reserve currency.

The summary of that is: Dollar Unipolarity is dying, and in its place rises a tide of global currency multipolarity, especially in countries where international commodity trade dominates.

We can see this in the rising price of dollar denominated commodities as they trade more and more in local currencies. Effectively, the currencies of these nations will rise relative to USD overtime if this continues. This, even while the other G7 nations lose ground to the dollar.

To be continued…

8- More Correlation Visualizations

Gold, CGB, UST…

Decreasing vol and increasing correlation of China Bonds to Gold price…

Same thing, drawn differently…

Same thing, drawn differently 2…

Gold/ CGB Clean… Feb 1 marked..

Gold, UST Feb 1 marked…

Lastly; What happened in February 2022 to make these correlations snap so strongly? The Ukraine war started, as did the US confiscation of Russian financial assets.

More here