Credit Suisse Group AG Chairman Axel Lehmann told a room of shareholders that he was “truly sorry” the Swiss bank imploded and for the controversial takeover by UBS.

“It is a sad day for you and for us too. I can understand the bitterness, the anger, and the shock of all those who are disappointed, overwhelmed, and affected by the developments,” Lehmann said in remarks prepared for the bank’s annual shareholder meeting in Zurich.

“I apologize that we were no longer able to stem the loss of trust that had accumulated over the years, and for disappointing you,” he said.

Lehmann, who has been chairman for a year, said that up until the bank failed and was forced by Swiss authorities to be taken over by rival UBS, he believed the 167-year-old bank was on a promising turnaround path after years of scandals, losses, and failures. He added the quick downward spiral of events last month indicated “the bank could not be saved.”

“Until the end, we fought hard to find a solution, but ultimately there were only two options: deal or bankruptcy,” Lehmann, who became chairman in January 2022, told shareholders. “The merger had to go through.”

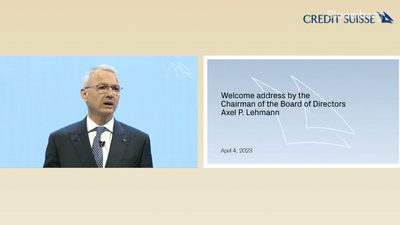

Here’s a clip of Lehmann’s apology to shareholders.

And clearly, failure wasn’t an option: On Monday, Swiss National Bank Vice President Martin Schlegel told broadcaster SRF in an interview that Credit Suisse faced imminent failure if not sold to UBS. He said, “It’s very, very likely a financial crisis in Switzerland and worldwide would have happened.”

Despite the merger preventing what could’ve been a financial nuclear bomb, shareholders at Zurich’s hockey stadium were still infuriated with Lehmann and other Credit Suisse execs.

“I wore my red tie today to represent the fact that I and plenty of others today are seeing red,” one shareholder who addressed the board and the audience said, who was quoted by WSJ.

Before today’s meeting, shareholders and proxy advisors said they would vote against the reelection of several board members, including Lehmann. However, it remains to be seen which of Credit Suisse’s top executives will survive the takeover.