Authored by Mike Shedlock via MishTalk.com,

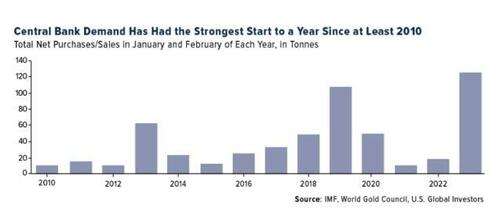

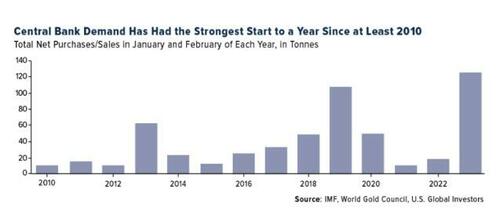

A reader wanted to know if central bank buying gold at a record pace adds to inflation. Let’s crunch the numbers then look at the true meaning of the buying spree…

Warren B. Mosler noted central bank are buying gold at a record pace and that adds to global inflation.

A second reader asked if I agreed.

Inflation Meaning

Q. What does central bank buying of gold mean for inflation?

A: Not much, per se, especially in the amount of purchases.

The Math

A metric ton of gold is 2204.62 pounds. There are 14.5833 troy ounces to a pound. That means there are 32,150.7 troy ounces per metric ton.

As of 11:45 PM on 2023-05-29, gold is $1952 per troy ounce.

One metric ton is worth 2022.62 * 14.5833 * $1952 per ounce = $62,701,106. Multiply that by 120 tons (lead chart) and you get $7,524,132,720.

With monstrous US deficits, and US debt approaching $32 trillion, $7.5 billion is not enough to matter in and of itself.

Stagflation Right Now, But What’s Ahead?

On April 28, I noted forces for inflation and deflation.

For discussion, please see Worst of Both Worlds, Stagflation Right Now, But What’s Ahead?

Understanding the Real Point

Buying gold has no direct impact on inflation. However, it’s important to note that the record pace is a result of US measures to weaponize the dollar.

Weaponizing the US dollar refers to actions by the US to confiscate Russia’s dollar reserves in response to the war in Ukraine.

Regardless of how one feels about the war or Putin, this was an unprecedented and illegal action by the US.

No Man’s Land

Weaponization of the US dollar will matter at some point, but it is difficult to say when because dollar avoidance itself is very difficult (see the first of two links below).

Weaponizing the Dollar

- March 18, 2022: What Does China Do With a Dollar That’s No Longer Risk Free? Buy Gold?

- May 13, 2023: Dollar Weaponization Expands – FDIC Message to Foreign Depositors Is Don’t Trust the US

The second point pertains to US actions regarding failed US banks in 2023 that further weaponized the dollar.

Weaponizing the dollar is a serious mistake, and it’s a Rubicon that cannot be undone.

So far, however, we are witnessing symbolic actions that eventually spell a currency crisis, but we are all guessing when that is.