“Geopolitics should continue to drive the gold price ahead of the US election”

Contents (2400 words)

Authored by GoldFix ZH Edit

- Intro: Price Drivers Scrutinized

- Key Points

- Editorial

- EM central banks’ diversification strategy

- Asian retail buying

- Technical analysis

- Appendix: Events and Asset Returns

Soc Gen’s “Conviction Thinking”

Intro: Soc Gen’s Price Drivers Scrutinized

In a well written report put out by Soc Gen’s Cross Asset Team made up of the bank’s Senior Commodity Strategist Florent Pele, Global Head of Asset Allocation Alain Bokobza, as well as heads of Commodity, Corporate, and even Technical trading; the bank seems to be “coming out of the gate” on gold now. Their assertions are clear and simple. The drivers pushing Gold prices higher will at least remain in place until the 2024 US Presidential election is resolved.

Given the current situation, Soc Gen says “stay positive on Gold”. Their contextual prerequisites are: inflation stickiness, problematic public deficits, geopolitical dangers, and diversification by central banks/monetary authorities. None of which they seemingly see has a significant hope of resolving until after the end of the year at earliest. We agree.

Before digging into this report, let’s first briefly address the probability each of the above contextual drivers remain in place.

- Bottom Line: Someone has to “shoot the moon” to fix this. Otherwise it will take decades to right itself. Ironically, one path to rectifying it (and the geopolitical situation) involves the US playing the role of a collapsing empire like the USSR with China’s economy ready an willing to fill the gap. That is not happening. The world cannot let the US leave the world stage anytime soon. We are closer to the beginning of this than the end.

Therefore, to summarize Soc Gen’s first sentence, and therefore the whole report we can say this:

The forces in play driving Gold higher have no chance of reversing meaningfully unless the following show signs of happening, 1.

- Trust Returns: Geopolitical cooperation begins to manifest again across ideological lines.

- Fiscal Restraint Returns: A non-inflationary solution for the deficit is found; via austerity, default, or some industrial technological breakthrough yet unseen. If a deficit solution is found and used, great care must then be used to ensure global economies do not degrade too quickly upon implementation. If they did, World War chances increase.

- Replacement Store of Value is Agreed Upon: A suitable replacement for Gold needs to be agreed upon as an alternative to UST in storing value for economies. Bitcoin comment in footnote2.

- One current candidate world leaders are looking for is possibly China’s bond market which is nowhere near ready. Even if their bonds were ready, no single nation will be trusted ever again, barring a global conflict that necessitates it. Multipolarity is here to stay. Gold is a part of that

Gold is going to structurally be underpinned with buying until those three things above show progress. As far as the actual report goes… Here are some excerpts transcribed.

(Emphasis ours)

2- Key Points

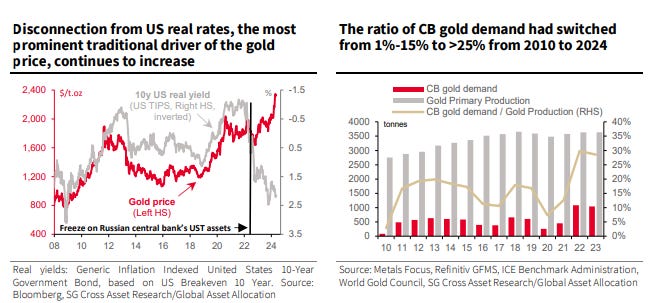

◼ Our analysis shows that current gold prices are not aligned with their usual drivers: US 10y real yields, the dollar index, and market risk appetite. In fact, the theoretical gold price, as defined by traditional pricing factors, was already much lower than the actual price prior to the $400/oz surge from mid-February to mid-March. [Edit- as stated here many times, Gold has new correlations asserting.]

◼ Central-bank demand for gold has once again become as a key driver of the gold price, especially demand from non-Western aligned countries of the Global South. In 2023, global central-bank purchases of gold amounted to over 1,000 tonnes, double the 2010-21 average.

◼ It is tricky to value gold price (no dividend distribution), which when compared to S&P 500 is at multi decade lows. Turning to technical analysis, we find that the gold price has been on a secular upturn since 2018 and see a possibility of it reaching the $2750/2770 level by year end.

◼ The gold price broke free from its usual drivers when the Ukraine war started.3 As a haven of last resort, gold has benefited from a world in which the number of identifiable tail risks has surged higher. In particular, we see no relief on geopolitical fears on the eve of the US elections (5 Nov 2024). This, in turn, should drive demand from central banks in the Global South, an idea we examined in our 2Q22 CT publication – here. Since then, the gold price has risen by 30.0%

3- Editorial

The traditional correlations with the gold price have shown substantial changes, particularly the relationships with the S&P 500, DXY, and real rates. This highlights the need to comprehend these dynamics to understand gold price behaviour. The ‘traditional’ drivers may now show weakened correlations or disconnection vs gold, but they remain significant nonetheless. Gold prices will still rise if real rates fall and equities crash, but the extent of the increase will be challenging to determine due to the emergence of new influential factors.

Continues here

Related posts: