The CBDC Anti-Surveillance State Act passed the United States House of Representatives on a largely partisan vote on May 23.

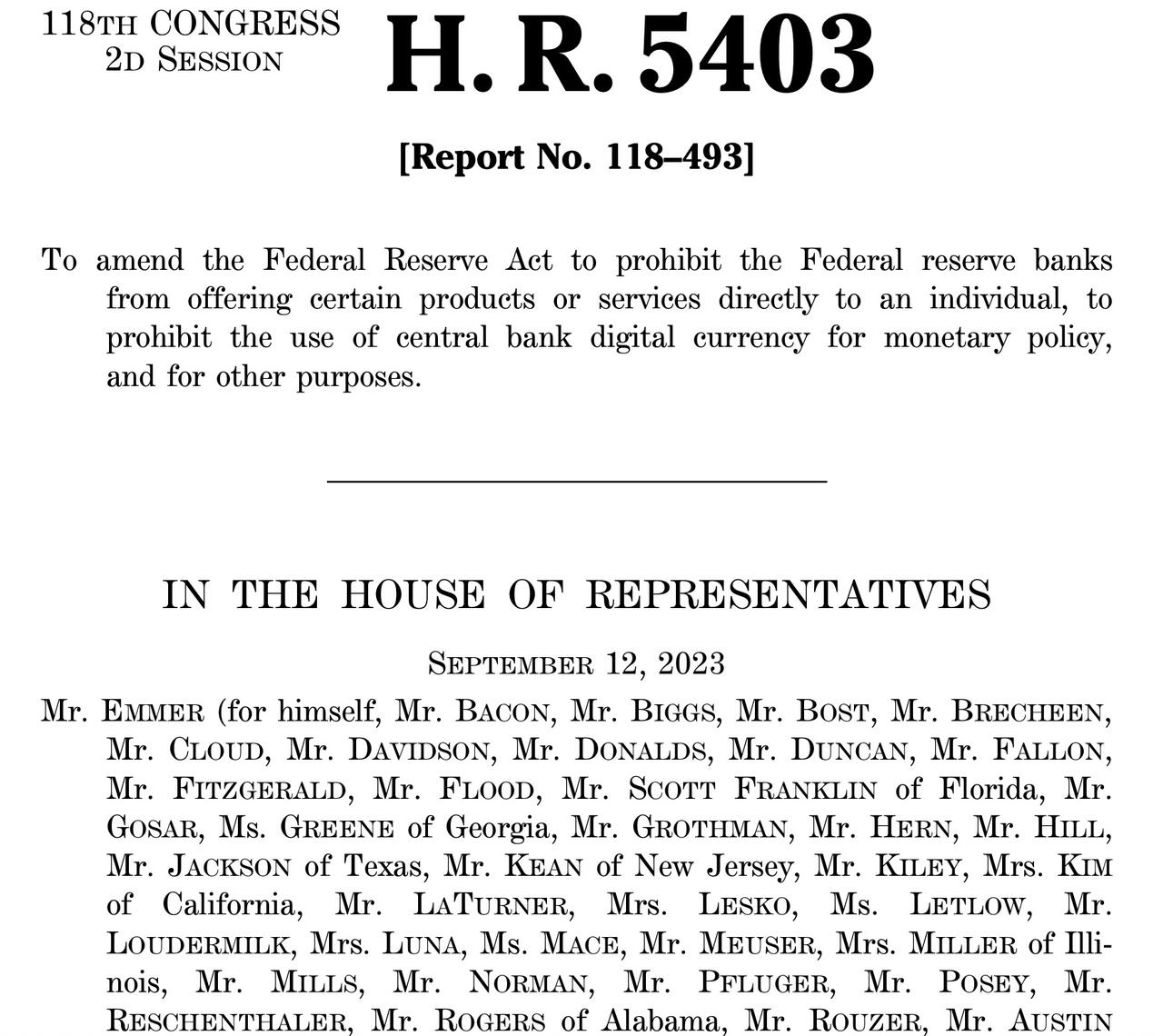

As CoinTelgraph’s Derek Andersen reports, the bill, which must still face a vote in the Senate, amends the Federal Reserve Act of 1913 to prohibit Federal Reserve banks “from offering certain products or services directly to an individual, to prohibit the use of central bank digital currency for monetary policy, and for other purposes.”

The Republican-backed bill’s debate was sparsely attended. Republican supporters spoke about the potential for the abuse of a central bank digital currency (CBDC), while Democrats concentrated on innovation, the dollar’s international competitiveness and the bill’s poor drafting.

French Hill, the Chairman of the Financial Services Committee Subcommittee on Digital Assets, Financial Technology and Inclusion, said:

“We live in a world where the government can abuse the tools it has.”

Representative Mike Flood reused his rhetorical device urging the audience to “imagine the politician you despise the most” with control over a CBDC.

Financial Services Committee member Warren Davidson called the New York Fed’s Project Hamilton “the same creepy surveillance tool” as China’s digital yuan. He said the pilot project “could be developed to something further.” The Fed was not responding to dialog, so it must respond to law, he said.

Warren called a digital currency the “creepiest surveillance tool known to man” that would lead to “coercion and control.”

“Why would we enable it?” he said. “Everywhere it’s depicted as evil.”

Davidson said the Fed should not pursue a digital currency without authorization from Congress, arguing it doesn’t have a place in a free society.

“We don’t want them to design it,” he said. “We don’t want them to build it.”

Frequent references were made to the digital yuan and the blockage of bank accounts in Canada during a trucker drivers’ demonstration against COVID-19 vaccination. Davidson also mentioned George Orwell – author of the novel 1984 – the New Testament Book of Revelations and the Deathstar – a device in the Star Wars film franchise – in his arguments.

The CBDC Anti-Surveillance State Act. Source: congress.gov

That idea was echoed by Rep. Alexander Mooney, author of an amendment to the bill that restricted CBDC research, who said a CBDC should not be “available at a moment’s notice.”

Marjorie Taylor Greene spoke about the “deep state” and the “Democrat regime.”

The exact implications of the bill were also disputed. Brad Sherman called the bill a “word salad” that favored “crypto bros.” He added that no one would be required to use a CBDC.

While Republican arguments focused on a retail CBDC, Financial Services Committee ranking member Maxine Waters claimed the bill could be construed to ban a wholesale CBDC as well.

Waters argued that the bill would “risk undermining the primacy of the U.S. dollar” globally.

The bill could also be interpreted to ban Federal Reserve holdings of bank reserves, which is necessary to administer payment systems, Waters said:

“[The bill] blocks the American economy as it operates today and has for decades.”

Waters also mentioned zero-knowledge proof technology that could guarantee user privacy. Dollar-pegged stablecoins could lose their value in a run, while a CBDC could not, she added.

Source: XRP Drops

Financial Services Committee member Jake Auchincloss said that his proposed bill, “Power of the Mint Act,” would accomplish similar goals without the drawbacks of the bill under consideration, but it had been blocked by Republicans.

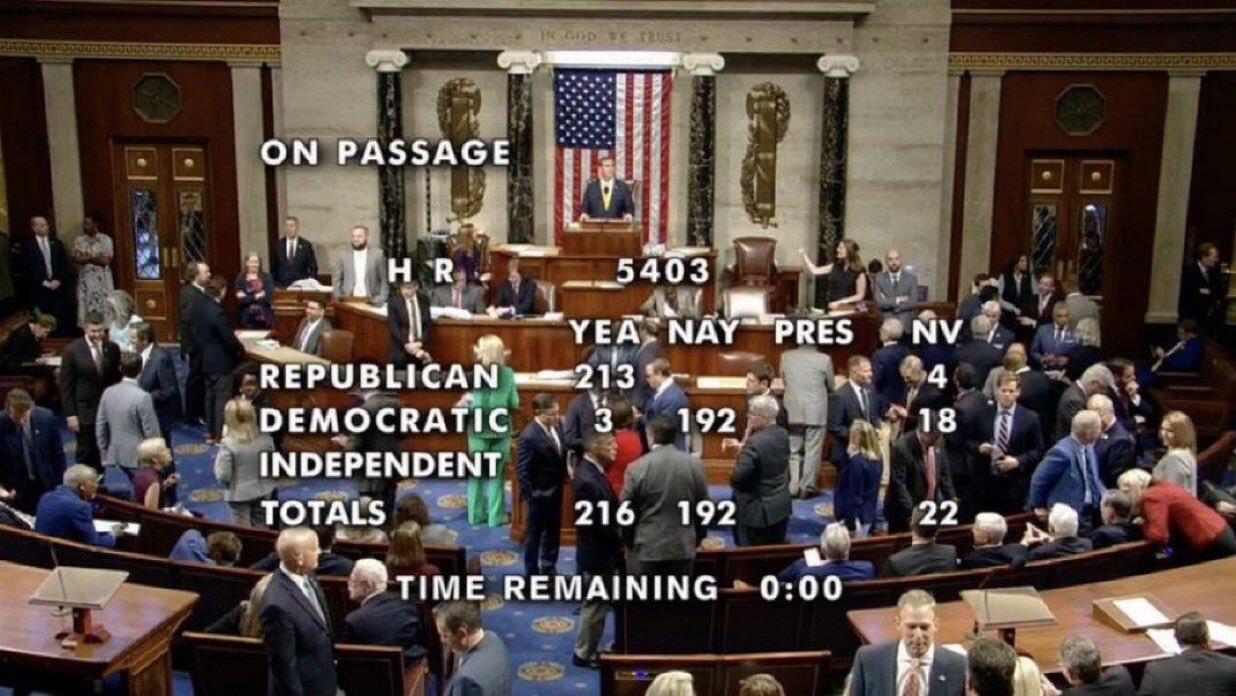

The CBDC Anti-Surveillance State Act was introduced into the House by Rep. Tom Emmer in February 2023. It passed by a vote of 216-192.

For the past two years, Jim Rickards – among many others – have been warning about the emergence of central bank digital currencies (CBDCs), or as some like to call the U.S. version, “Biden Bucks.”

These Biden Bucks would have the full backing of the U.S. Federal Reserve. They’d replace the cash (“fiat”) dollar we have now. And if Biden got his way, they’d be the sole, mandatory currency of the United States.

What does this mean for you?

As Rickards details below, it would make your money less truly your own. It would be subject to government control.

Biden Bucks are being peddled as a more efficient and convenient form of money. They say they’re just simplifying the payment system and making it more efficient. It’ll be much more convenient than the convoluted system we have today.

And they’re actually right about that. A digital dollar will be simpler, more efficient and more convenient to use.

Assume you buy gasoline at your local gas station. You pay with a credit card, which begins a payment process involving maybe five separate parties.

These include the merchant from whom you bought the gas, the credit card company, the bank and an intermediary called a merchant acquirer (no need to explain what a merchant acquirer does for today’s purposes, but just realize that it’s part of the payment system).

Ultimately the bank that issues your credit card sends you a bill, which you pay. You also pay a fee, maybe 3%, all to buy the gas.

But with a central bank digital currency, you could simply pay for the gas with an account you have at the Fed.

You would get rid of all the middlemen. You could bypass the merchant acquirer, the banks and the credit card company. A digital dollar would also eliminate many of the fees we currently face.

So yes, the payment system would be faster, cheaper, easier, more streamlined and more secure. What’s not to like as far as you’re concerned?

Well, if you’re concerned about your personal privacy, everything.

We Can’t Let You Destroy the Environment

Imagine this. To further advance his Green New Scam, what if Joe Biden and his cronies decided that gasoline needed to be rationed?

Your Biden Bucks could be rendered useless at the gas pump once you’ve purchased a certain amount of gasoline in a week! You want gas, but all you get is a one-word message: Declined.

How’s that for control?

Biden Bucks would create new ways for the government to control how much you could buy of an item, or even ban purchases altogether. It would keep score of every financial decision you make.

In a world of Biden Bucks, the government will even know your physical whereabouts at the point of purchase.

It’s a short step from there to putting you under FBI investigation if you vote for the wrong candidate or give donations to the wrong political party. If any of this sounds extreme, fantastical or otherwise far-fetched, it’s not.

Look at all the ways the government has abused its power to target its opposition in recent years.

Government Always Wants More Power

From unconstitutional “lawfare” against Trump, to the jailing of harmless J6 protesters who did nothing more than walk around the Capitol taking selfies (I’m not talking about those who committed violence that day, who should be punished to the full extent of the law), the federal government has overstepped its bounds.

Several months ago, the FBI and Financial Crimes Enforcement Network (FinCEN) sent letters to U.S. banks asking them to identify and provide a list to the government of customers using Zelle, Venmo and similar payment channels who mentioned “MAGA,” or “Trump” in their message traffic.

They also asked for details on bookstore purchases of religious articles including Bibles. Finally, they asked for details on those shopping at Cabela’s, Dick’s Sporting Goods or Bass Pro Shops, presumably on the view that those are places to buy guns and ammo.

This is a clear-cut violation of the First Amendment (free speech, freedom of religion), Second Amendment (right to bear arms) and Fourth Amendment (no unreasonable search and seizure).

It’s not a crime to write “MAGA,” etc. and therefore there’s no reasonable basis for suspecting a crime, and therefore no right to get the information without a warrant, which requires a judge. Any judge would likely reject the warrant request since there’s no probable cause.

This is an obvious case of profiling. If you shoot someone and you’re wearing a MAGA hat, you get arrested for the shooting, not the hat. In this case, the hat is enough to put you under surveillance because you have been profiled as “an enemy of the people” by the government’s definition.

I predicted this kind of surveillance would arise with the use of Biden Bucks since the government would have your financial records and would not have to go to the banks or get a warrant. I’d like to say I was wrong, but unfortunately I was right.

Why do you think it would stop there? Government always seeks to expand its power.

The Slippery Slope

In the latest example of federal overreach, the latest update of the IRS Internal Review Manual expands the scope of IRS investigation and audit activity to include anyone who impedes the government’s “ability to govern” or who poses a “threat to public safety or national security.”

Such phrases sound benign when applied to foreign terrorists or criminal masterminds. Then you realize they can just as easily be applied to political opponents, Trump supporters, podcasters, opinion writers, political organizers or everyday Americans who stand in the way of the administration’s ambitions.

The IRS can use threats of audits and investigations to intimidate social media platforms like Google, Facebook and Instagram into shutting down MAGA Republicans and others who oppose Biden policies.

The updated IRS manual also allows the IRS to leak taxpayer information to the Justice Department, the Department of Homeland Security or other agencies with enforcement power in order to sic those agencies on targeted victims.

This happens in a context where simple political opposition has been criminalized giving the IRS carte blanche to choose their victims. If you’re outspoken against the Biden administration, keep your tax records handy and get ready for a knock on the door.

So, again, why would you be surprised if the government used Biden Bucks to punish its political opponents? It’s just the natural progression.

Can it be stopped? There’s one possibility — and it comes from the individual states.

The Last Hope?

Last year, Indiana became the first state to reject CBDCs as a form of money. This year it enacted an additional measure that prohibited state agencies from accepting CBDCs as payments.

Florida, North Dakota, South Dakota, Tennessee, Utah, Alabama and Georgia have passed similar laws to block the imposition of CBDCs.

Will they succeed? It would be a triumph of federalism if they did, which has a rich American tradition.

But proponents of Biden Bucks invoke Article VI, Paragraph 2 of the Constitution, otherwise known as the federal Supremacy Clause. It establishes that the federal law takes precedence over state law.

Over the years, the federal government has gradually expanded its powers under the Supremacy Clause.

It might be an uphill battle, but the states might just be our best defense against the implementation of Biden Bucks.