While the market remains focused on CPI print, and to a lesser extent the April retail sales reports, which will both be released at 8:30am on May 15. we should flag another important report that doesn’t typically get a lot of attention: the New York Fed’s Household Debt and Credit Report for 1Q 2024 which was just published, and where the latest data on credit card debt and delinquencies has recently been the most important part of the report.

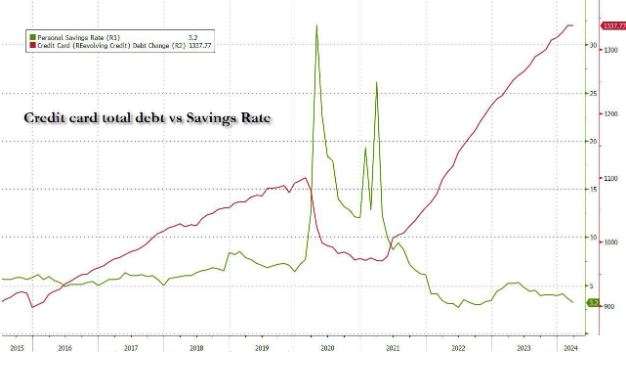

While we already know that in the latest monthly consumer credit report published by the Fed earlier and covering the month of March, total consumer debt hit a record high (despite a sharp slowdown in credit card growth) even as the personal savings rate plunged to an all-time low, hardly a ringing endorsement for the strength of the US consumer…

… report provided more granular details which however did not change the conclusion: the US consumer is getting weaker, and while not in a crisis just yet, will get there soon enough.

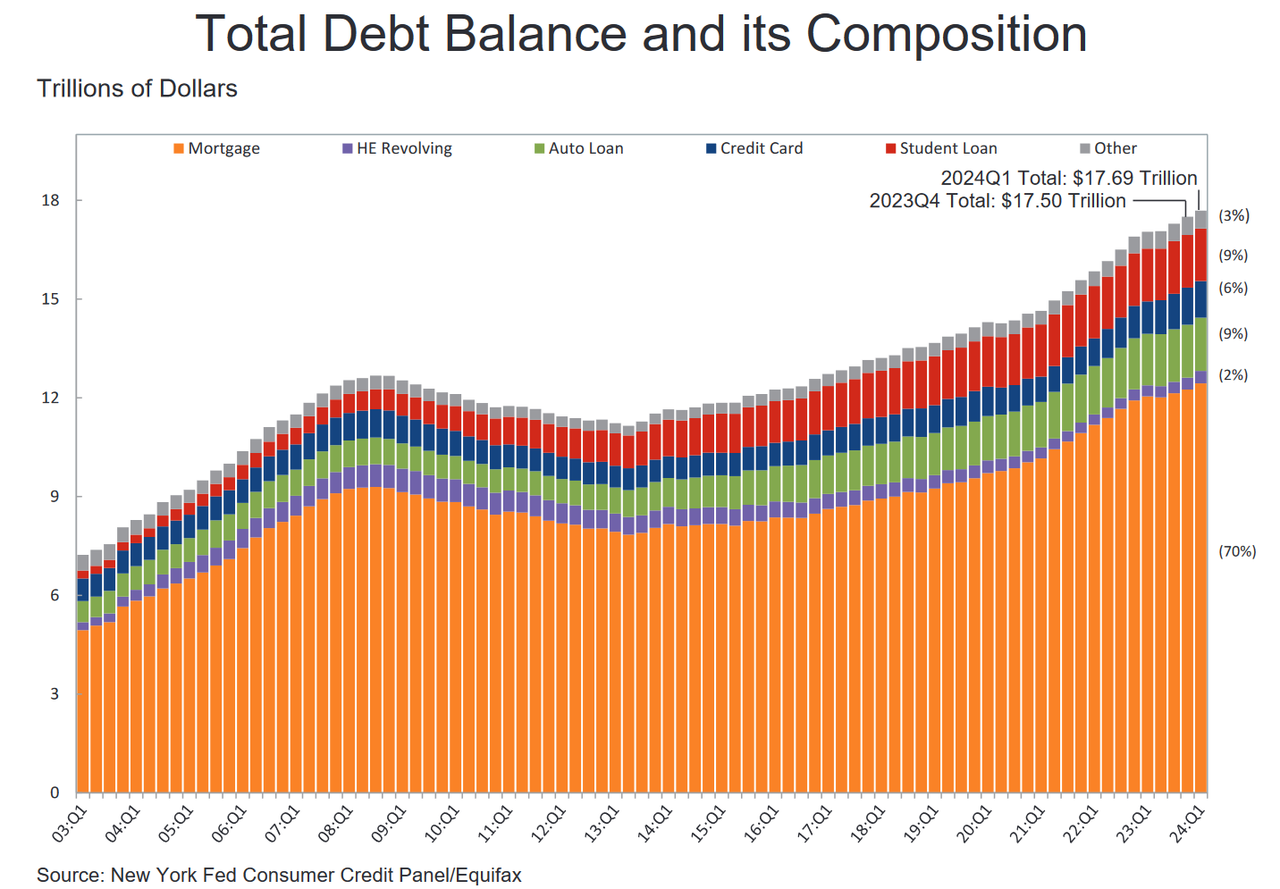

As the chart from the NY Fed shows, at the end of the first quarter, US household debt reached a record and more borrowers are struggling to keep up: overall US household debt rose to $17.69 trillion, the NYFed’s Quarterly Report on Household Debt and Credit revealed (link here). That’s an increase of $184 billion, or 1.1%, from the fourth quarter.

Consumers have added $3.4 trillion in debt since the pandemic, and that increased debt bears much higher interest rates.

And with both credit card rates and total credit at all time highs, the data corroborate the mounting financial pressures on American families in an age of elevated inflation. The persistent rise in the prices of essentials such as food and rent have strained household budgets, pushing people to borrow against their credit cards to pay for necessities.

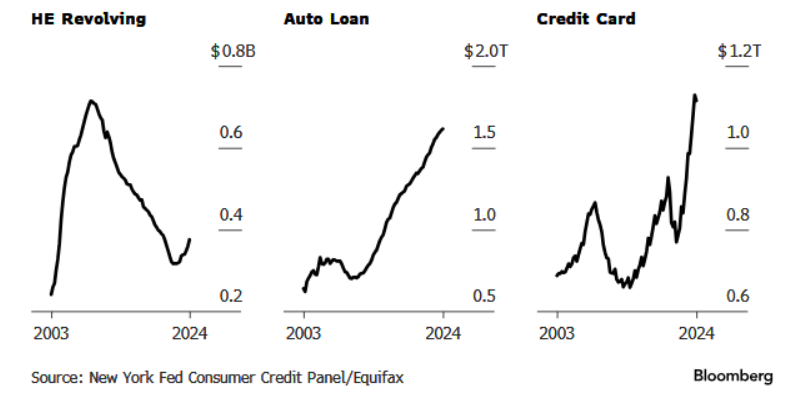

Total credit card debt stood at $1.12 trillion in the first quarter of 2024, according to the report (the number diverges from the monthly print reported in May by the NY Fed and which was much higher), but an increasing number of borrowers are behind on credit card payments. While down slightly sequentially according to this data set (if not the NY Fed’s other data set), the number in line with seasonal patterns of consumers paying debt incurred over the holidays. But as Bloomberg notes, credit card balances are up almost 25% from the first quarter of 2020.

“Credit card balances usually rise in the second and third quarters and then they really tend to spike around the holidays in Q4,” Ted Rossman, a senior analyst at Bankrate, wrote in a note to clients. “With inflation and interest rates likely to remain elevated, there’s a very good chance credit card balances will surge to new highs later in 2024.”

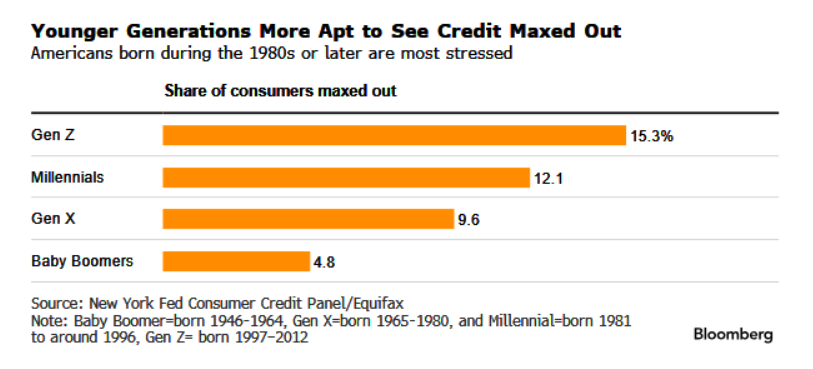

Meanwhile, in a blog post by NY Fed economists, they cautioned that “consumers facing a financial squeeze may be maxing out their credit cards and falling behind on payments” and added that “one observable factor that is strongly correlated with future delinquencies is a high credit card utilization rate.”

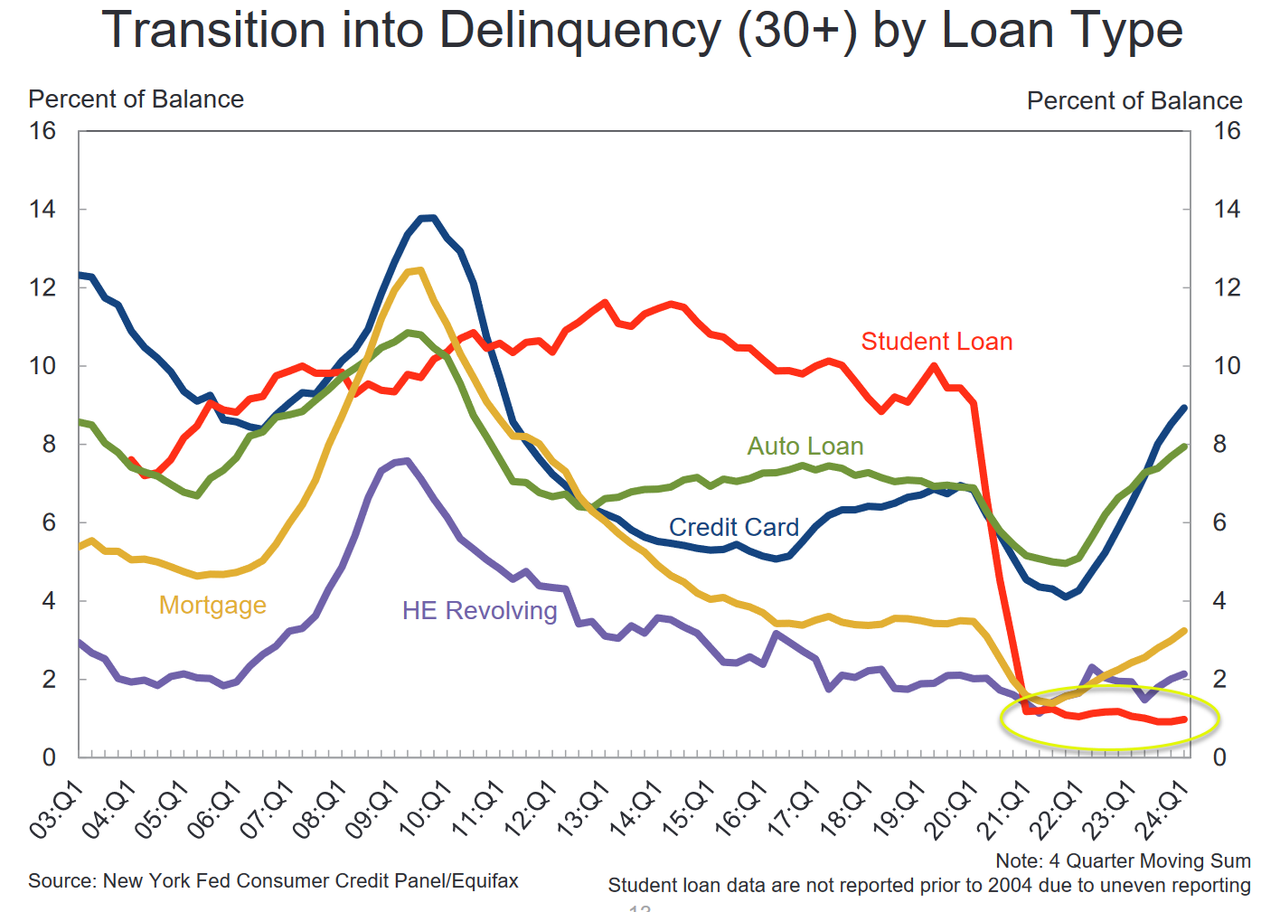

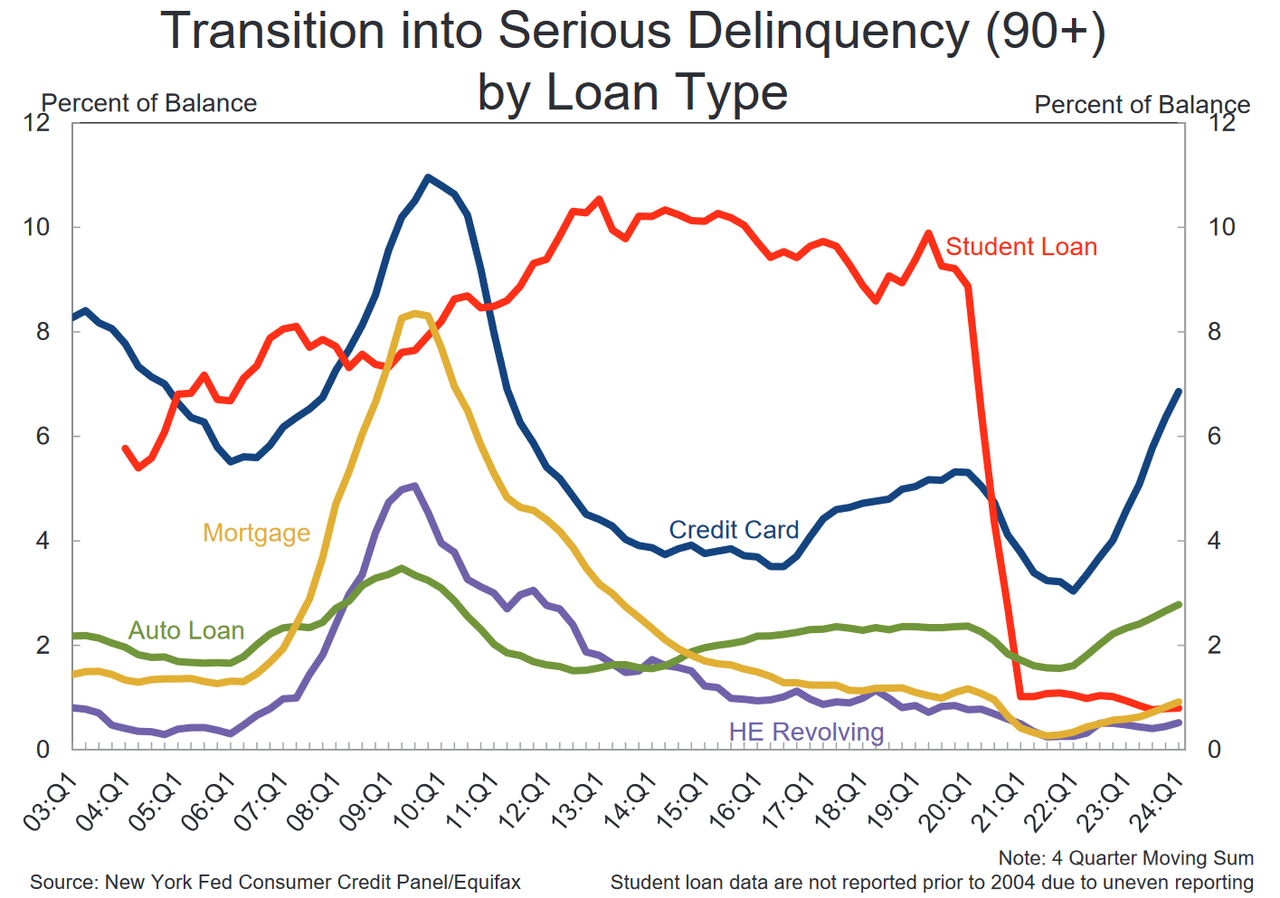

“In the first quarter of 2024, credit card and auto loan transition rates into serious delinquency continued to rise across all age groups,” said Joelle Scally, Regional Economic Principal within the Household and Public Policy Research Division at the New York Fed. “An increasing number of borrowers missed credit card payments, revealing worsening financial distress among some households.”

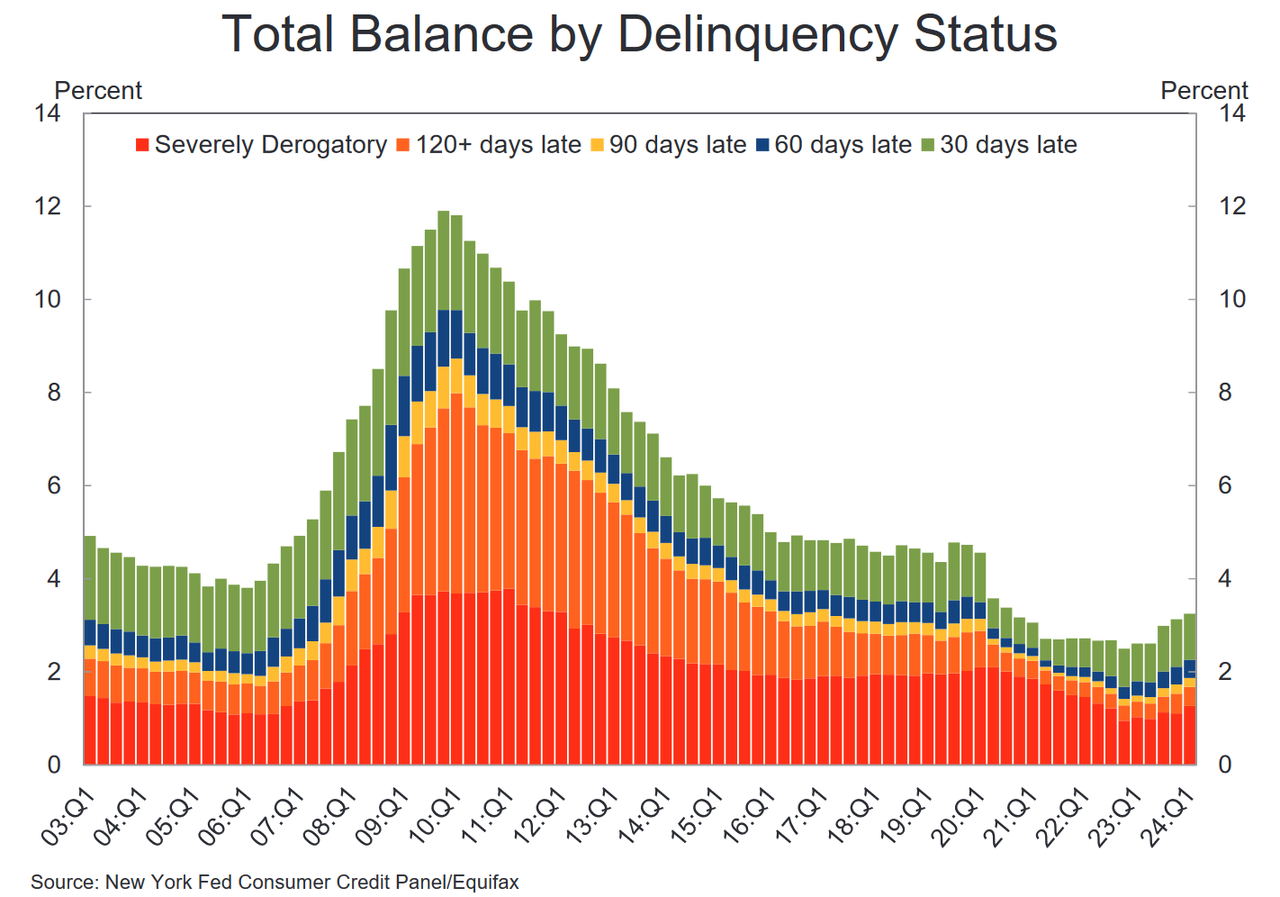

As of March, 3.2% of outstanding debt was in some stage of delinquency. That remains still 1.5% points lower than the fourth quarter of 2019, but delinquency transition rates increased for all product types, according to the Fed. And also interest rates before covid were about 5% lower.

In a separate post, economists at the St. Louis Fed pointed out that credit card delinquency rates are returning to historically more normal levels after pandemic-related government assistance programs pushed them to unusually low numbers. They added, however, that “present levels of credit card delinquency are greater than pre-pandemic levels, suggesting that a trend which began prior to the pandemic has accelerated.”

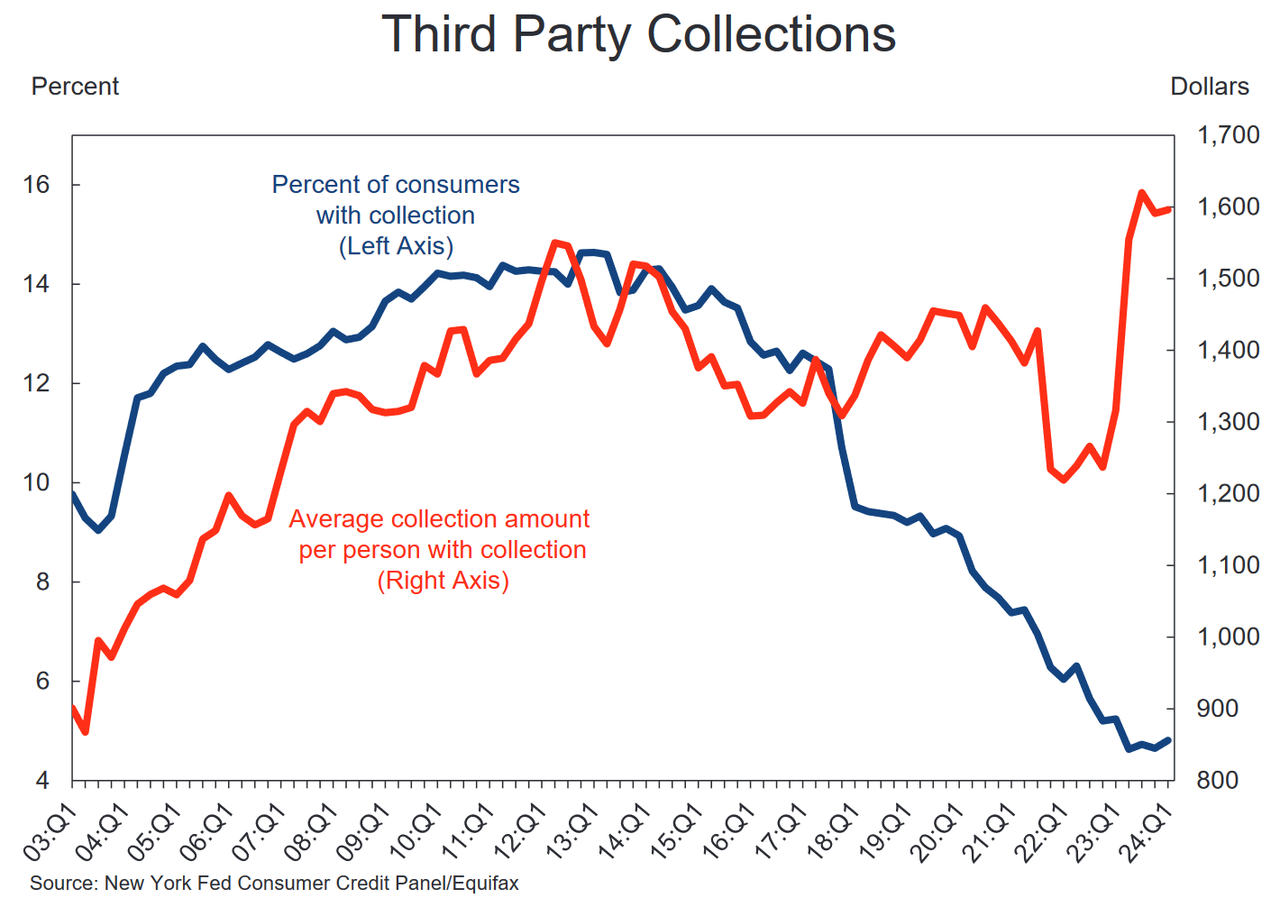

About 121,000 consumers had a bankruptcy notation added to their credit reports last quarter, and approximately 4.8% of consumers held some debt in third-party collections. What is remarkable is that those consumers currently in collection have the highest number on record in collection amounts. Which means that once the delinquency train finally leaves the station, and creditors start collecting in earnings, the amount of debt in 3rd party collections will be literally off the chart!

And the clearest hint that we are getting there, is that borrowers using more than 60% of their credit are falling into delinquency at a faster pace than before the pandemic, making up most of the increase in credit card delinquency rates. About a third of balances associated with borrowers using more than 90% of their credit became delinquent in the past year, compared to about 25% before the pandemic.

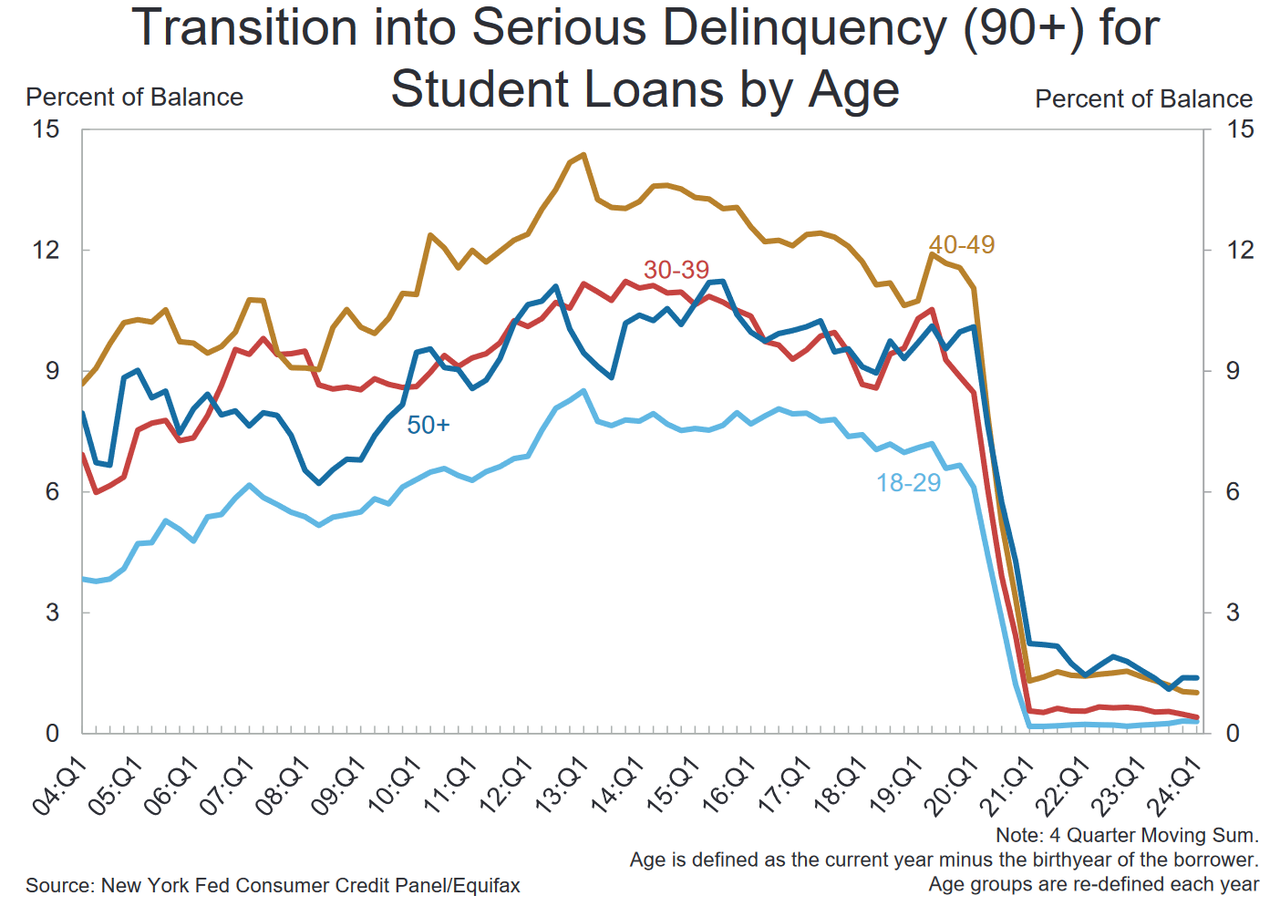

What is most remarkable here is that despite a so-called end to the student loan repayment moratorium, it appears that not only is nobody repaying their student loans, but that debt issuers aren’t even bothering to make the delinquent debt as such (then again, it is difficult to determine how much of that debt is delinquent as missed federal student loan payments will not be reported to credit bureaus until the fourth quarter).

The data also show a wide range in credit card utilization rates. About one in six credit card users are using at least 90% of their available credit. And an additional 11% are using between 60% and 90% of their available credit.

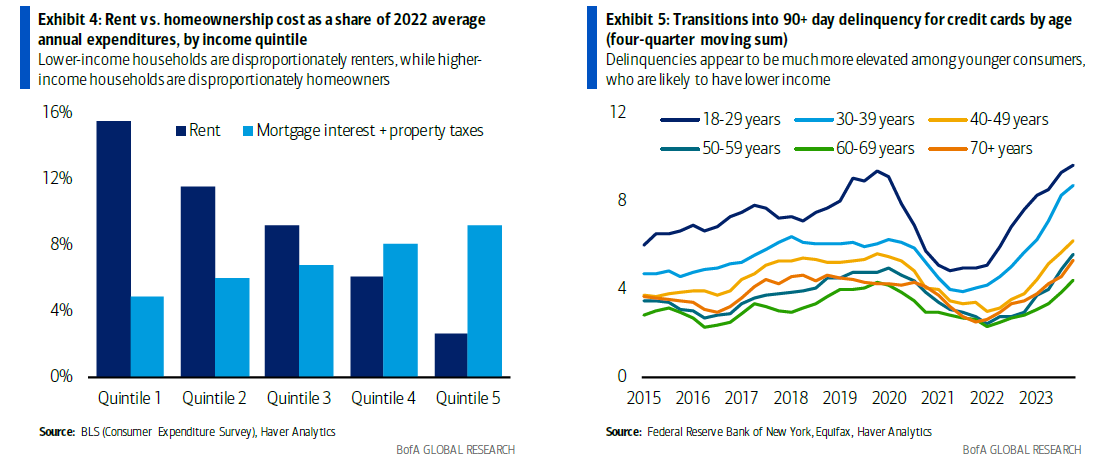

The Fed researchers found younger borrowers and those with lower incomes are more apt to be financially stressed than older borrowers and those with higher incomes, who may have more credit available. “Millennials were the only group whose delinquencies exceeded their pre-pandemic rate,” New York Fed researchers wrote in a blog post.

The Fed’s report showed 6.9% of credit card debt transitioned to serious delinquency last quarter, up from 4.6% a year ago. And for credit card holders aged 18–29, 9.9% of balances were in serious delinquency.

Auto loan delinquencies are also higher as the average monthly car payment jumped to $738 in 2023. Close to 2.8% of auto loans are now 90 or more days delinquent — that equates to more than 3 million cars. Auto loans are the second-largest debt category following mortgage debt, with $1.62 trillion outstanding.

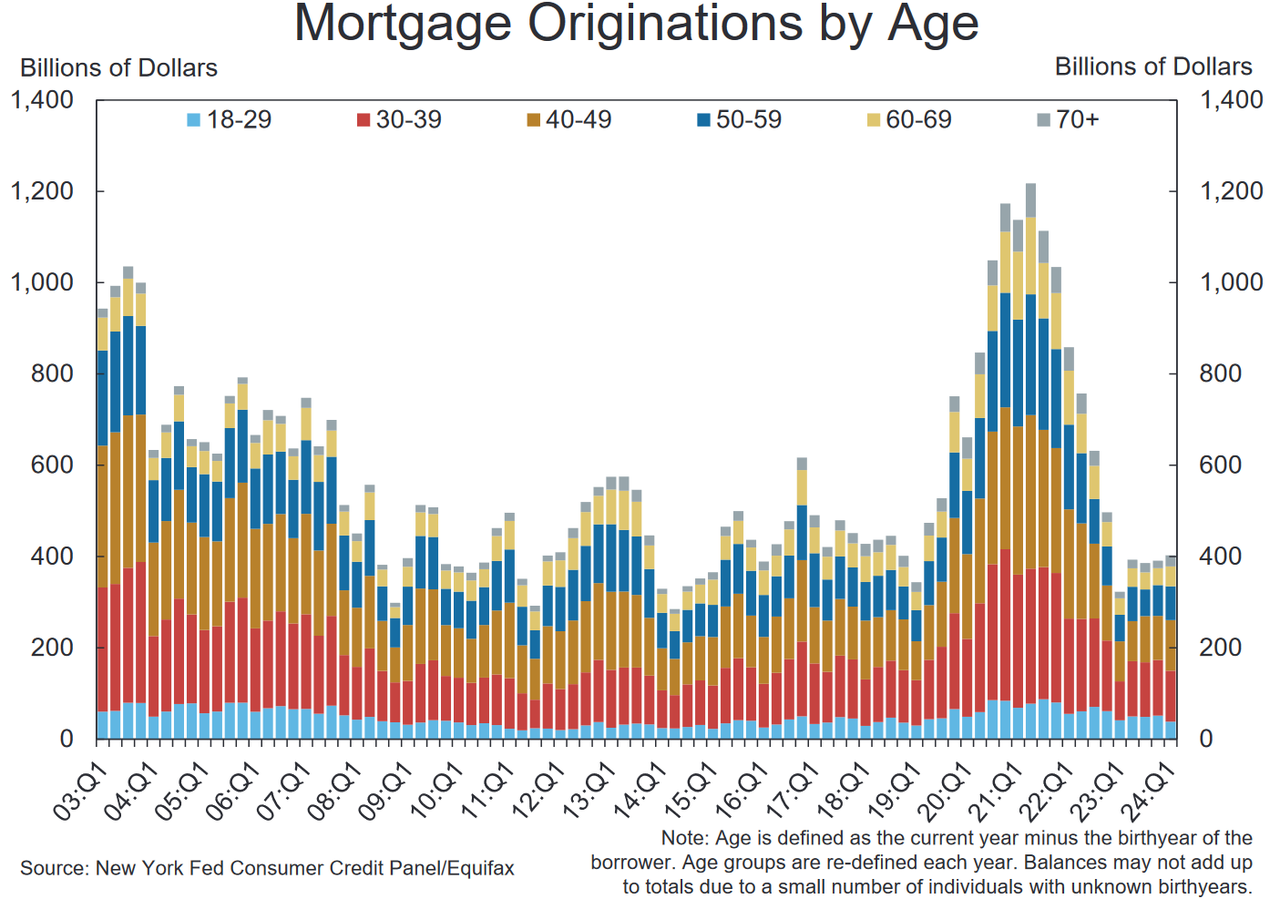

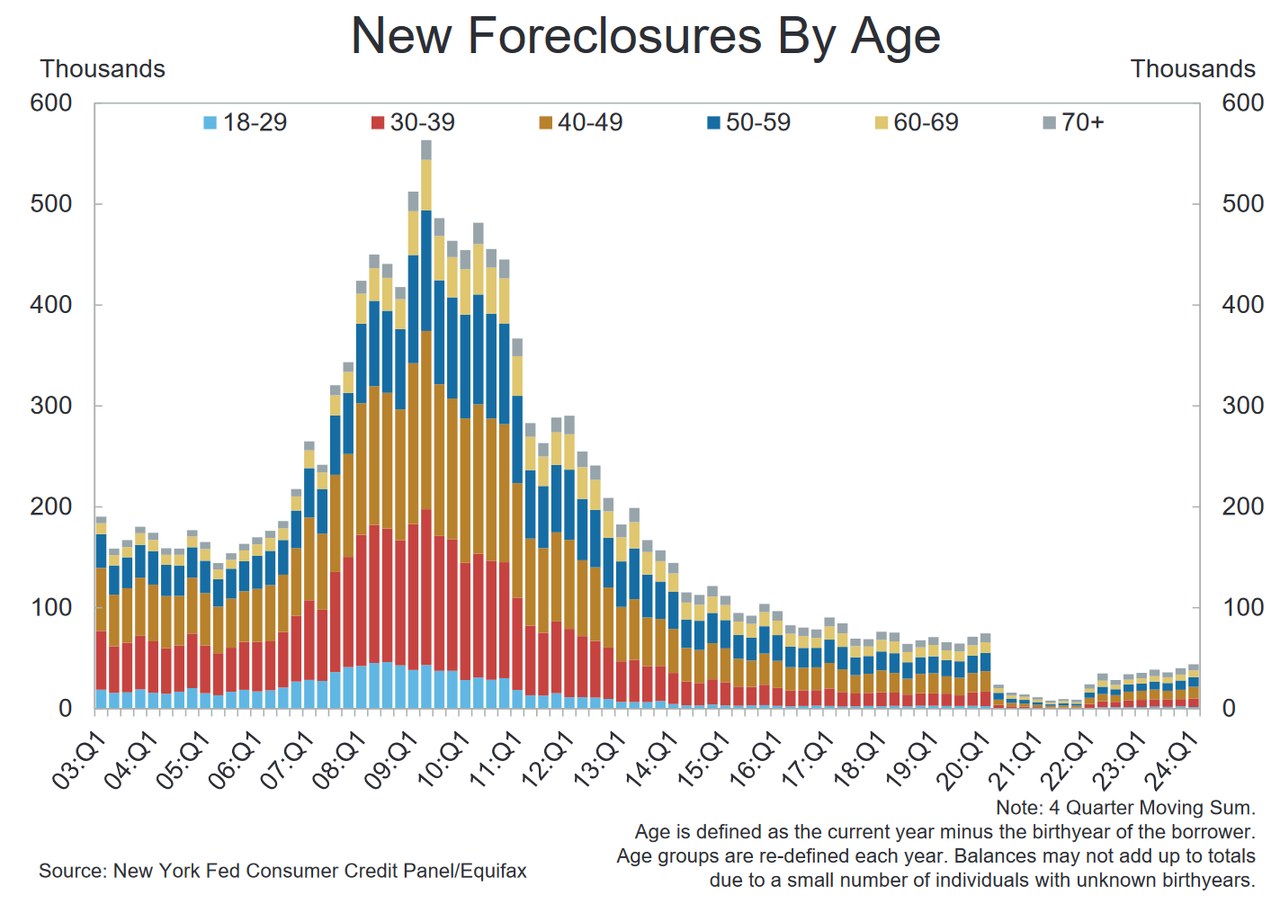

The biggest household debt holding is for housing. It accounts for more that 70% of the total. That debt is performing well, but homeowners are increasingly tapping their accumulated home equity in the form of a home equity loans, meanwhile new mortgage originations have tumbled near record low levels as a result of the soaring rates…

… which also means that foreclosures are starting to tick up.

Meanwhile, on the other side of the table, some $16 billion in additional home equity loans was originated — the biggest increase since 2008 — and $37 billion was added over the past year. Homeowners have about $580 billion in outstanding home equity credit available, the most in about 15 years.

So what to make of this information, especially when even the Fed is warning that the US consumer is in increasingly weak shape.

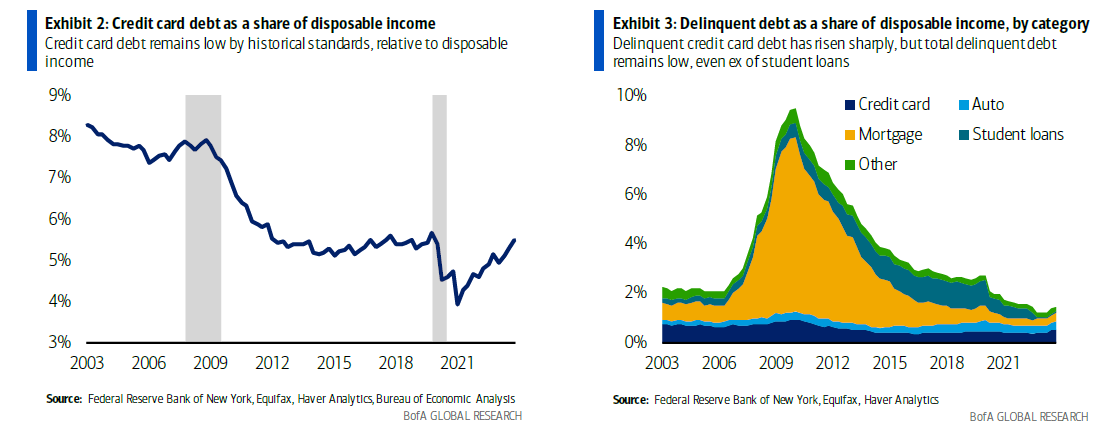

Well, credit card debt has increased sharply in recent quarters. When it surpassed $1.0tn for the first time in history in 2Q 2023, alarm bells went off in some circles, although according to Bank of America’s (especially sanguine) economists, the surge in credit card debt is partly just a normalization, after consumers used their fiscal stimulus windfalls to pay down their balances in 2020-21. Moreover, they note that even setting aside the structural drift away from cash, credit card debt should scale up with the nominal economy. As a share of disposable income, total credit card debt in 4Q 2023 was still below its pre-pandemic level.

Instead of the total credit number, BofA urges clients to pay more attention to credit card delinquencies: the total amount of delinquent credit card debt stood at $110bn as of 4Q 2023, up 42%; that number grew even higher in Q1 2024.

To put these numbers in context, BofA offers two approaches: first, why you shouldn’t worry too much

- How much will surging delinquencies weigh on consumer spending? The good news is that credit cards make up only 6.5% of total consumer debt. Despite the recent increase, delinquent credit card debt accounts for only 0.5% of total disposable income.

- Meanwhile, mortgages make up 70% of consumer debt and are by far the biggest swing factor for total delinquencies. A large share of households is locked into low fixed-rate 30-year mortgages. This has kept mortgage delinquencies, and total delinquent debt, very low by historical standards, and made consumer spending more resilient to Fed hikes than in the past. Even when student loan delinquencies finally do normalize, that would not move the needle a great deal assuming mortgage debt remains stable.

And then, here is why you should worry:

- So far so good, but the picture gets a little more concerning at the lower end of the income distribution. Lower-income households are less likely to be homeowners, so they are benefiting less from low fixed mortgage rates. Meanwhile, they are more likely to also be delinquent on their credit cards. From this fact, one can conclude that credit card delinquencies appear to be higher among younger consumers (who would, on average, have lower income.

- Further, delinquencies might understate the issues consumers are facing due to credit card debt. There is likely a large group of consumers who are paying their minimum balances, and so are not delinquent, but are unable to pay the full balance, and so are paying high APRs (annual percentage rates) on the overdue amounts. APRs have risen significantly due to Fed hikes, increasing the strain on such consumers.