A week after an employee of the world’s largest asset management company, BlackRock, described how the company attempts to stay out of the media spotlight while buying politicians and profiting off of war (according to undercover footage obtained by the O’Keefe Media Group), we thought it worth a look at just what companies does the 34-year-old company have the most control of.

As a reminder, in footage secretly recorded by undercover journalists in New York, a BlackRock recruiter named Serge Varlay explains how the investment company is able to “run the world.”

“They [BlackRock] don’t want to be in the news. They don’t want people to talk about them. They don’t want to be anywhere on the radar,” Varlay said.

Varlay told a OMG journalist in the footage that BlackRock manages $20 trillion worldwide (it’s actually around $9 trillion). “It’s incomprehensible numbers,” he said.

“You can take this big f***ton of money and buy people, I work for a company called Black Rock… It’s not who is the president it’s who is controlling the wallet of the president.

You could buy your candidates. First, there is the senators these guys are f***in cheap. Got 10 grand you can buy a senator. I’ll give you 500k right now. It doesn’t matter who wins, they’re in my pocket.”

– Serge Varlay

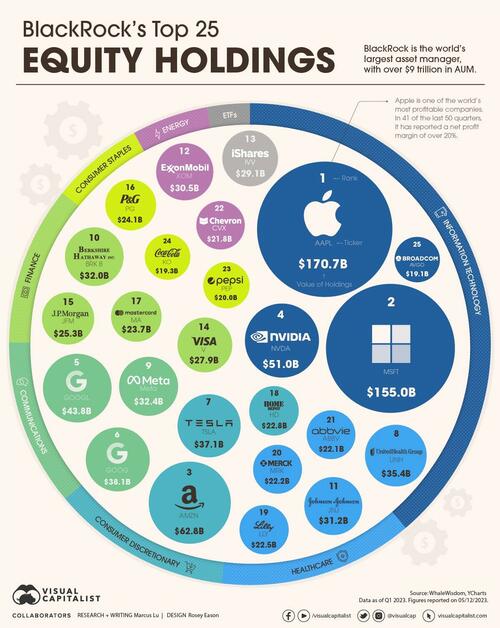

Given this status, BlackRock’s equity portfolio may provide useful insights to investors. To learn more, Visual Capitalist’s Marcus Lu and Rosey Eason visualized the firm’s top 25 equity holdings as of Q1 2023. At that time, these 25 positions were worth over $1 trillion, and they represented about 30% of BlackRock’s overall equity portfolio.

Top 25 Data

The following table shows the data we used to create this infographic. These figures come from BlackRock’s latest 13F filing, which was released on May 12.

ℹ️ The 13F is a mandatory, quarterly report that is filed by institutional investment managers with over $100 million in AUM.

| Rank | Name | Sector | Value of Holdings (USD billions) |

|---|---|---|---|

| 1 | Apple | Information Technology | $171 |

| 2 | Microsoft | Information Technology | $155 |

| 3 | Amazon | Consumer Discretionary | $63 |

| 4 | Nvidia | Information Technology | $51 |

| 5 | Google (Class A) | Communications | $44 |

| 6 | Google (Class C) | Communications | $38 |

| 7 | Tesla | Consumer Discretionary | $37 |

| 8 | UnitedHealth Group | Health Care | $35 |

| 9 | Meta | Communications | $32 |

| 10 | Berkshire Hathaway (Class B) | Finance | $32 |

| 11 | Johnson & Johnson | Health Care | $31 |

| 12 | Exxon Mobil | Energy | $30 |

| 13 | iShares Core S&P 500 ETF | ETF | $29 |

| 14 | Visa | Finance | $28 |

| 15 | JPMorgan Chase & Co | Finance | $25 |

| 16 | Procter & Gamble Co | Consumer Staples | $24 |

| 17 | Mastercard | Finance | $24 |

| 18 | Home Depot | Consumer Discretionary | $23 |

| 19 | Eli Lilly And Co | Health Care | $23 |

| 20 | Merck & Co | Health Care | $22 |

| 21 | AbbVie | Health Care | $22 |

| 22 | Chevron | Energy | $22 |

| 23 | PepsiCo | Consumer Staples | $20 |

| 24 | Coca-Cola Co | Consumer Staples | $19 |

| 25 | Broadcom | Information Technology | $19 |

As expected, BlackRock’s top equity holdings include America’s most established tech companies: Apple, Microsoft, Amazon, and Google.

BlackRock also has large positions in Nvidia and Broadcom, which happen to be America’s two largest semiconductor companies. Given Nvidia’s incredible YTD performance (198% as of June 19th), this position has likely grown even bigger.

Altogether, tech stocks make up 39% of this top 25 list. The next biggest sector would be healthcare, at 13% of the total value.

Ownership Stakes

How much of a controlling stake does BlackRock have in these companies? We answer this question in the following table, which again uses Q1 2023 data.

| Name | % Ownership | Quarter 1st Owned |

|---|---|---|

| Merck & Co | 8.24% | Q3 2007 |

| UnitedHealth Group | 8.02% | Q4 2008 |

| Berkshire Hathaway (Class B) | 7.98% | Q3 2007 |

| PepsiCo | 7.96% | Q3 2007 |

| AbbVie | 7.86% | Q1 2013 |

| Home Depot | 7.60% | Q3 2007 |

| Nvidia | 7.44% | Q3 2007 |

| Microsoft | 7.22% | Q3 2007 |

| Coca-Cola Co | 7.20% | Q3 2007 |

| Broadcom | 7.16% | Q3 2009 |

| Google (Class A) | 7.09% | Q3 2007 |

| Chevron | 7.02% | Q3 2007 |

| Eli Lilly And Co | 6.90% | Q3 2007 |

| Mastercard | 6.89% | Q3 2007 |

| Procter & Gamble Co | 6.86% | Q3 2007 |

| Exxon Mobil | 6.83% | Q3 2007 |

| JPMorgan Chase & Co | 6.59% | Q3 2007 |

| Visa | 6.55% | Q2 2008 |

| Apple | 6.54% | Q3 2007 |

| Johnson & Johnson | 6.46% | Q3 2007 |

| Google (Class C) | 6.13% | Q2 2014 |

| Amazon | 5.93% | Q4 2008 |

| Tesla | 5.70% | Q3 2010 |

| Meta | 5.69% | Q2 2012 |

When it comes to shareholder voting, BlackRock has historically voted on behalf of its clients to “advance their long-term economic interests.” Given its massive size, some people believe that BlackRock has too much influence on major corporations.

In 2021, it was reported that BlackRock would begin allowing some institutional clients to cast their own votes at shareholder meetings.